what happens to the bond market when stocks crash

"Plummet" is the almost frightening give-and-take in any investor's vocabulary.

It refers to a steep and sudden decline in stock prices much larger than the standard -20% definition of a acquit market place.

Fortunately, such collapses are rare. But they all have one thing in common: liquidity — the presence of willing buyers — evaporates.

In today's video, I explain how these dreaded events occur … and what to watch for when one threatens.

(Click here to picket at present.)

Transcript

Hello everyone, it's Ted Bauman hither, editor of The Bauman Letter and Bauman Daily with your weekly Friday video. Sorry, I missed you concluding week, but I had just arrived in South Africa and things were … shall we say a piddling disjointed considering my bag was late and we had a few product issues on this side because of that, but I'k back to normal. This is my Southward African office. You can see it's a little different, not quite every bit fancy, but I am downwards here working on my house. Anyhow, today I want to talk about the one affair that y'all need to look out for if you suspect that a stock market place crash is on the way. I've chosen that not because I think that one is on the manner, but because they accept occurred regularly in history and ane of the most mutual questions I become as a Bauman Letter author and as a financial announcer is, "What causes crashes? When might it happen? How do we know if one is coming?"

And so, I thought today I would review that. Let'south start by looking at the background to crashes and what has happened over the form of many, many years. Well, hither'due south a list of stock marketplace crashes:

- Panic of 1907 — stocks brutal by twenty% in one mean solar day.

- The Wall Street Crash of 1929 — Dow dropped 25% in 4 days, eventually losing 90% of its value.

- Crash of 1973-1974 — S&P 500 lost 50% of its value.

- Flash Crash of 1987 — Dow shed 22% in one day.

- Dot-com Crash of 2000 — Nasdaq declined past twoscore% over 2 ½ years.

- Subprime Crisis of 2008 — S&P 500 vicious by over 50% over 2 years.

- COVID crash of 2020 — Southward&P 500 fell past nearly 35% in one month.

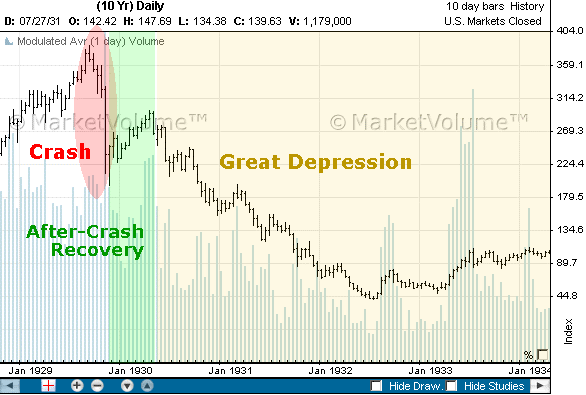

A crash is typically defined as a fall in the value of the stock market. More than 20% which is the technical definition of a correction or deplorable, of a bear market. It's when it happens in a matter of a brusk period of fourth dimension. In other words, when it happens over even a couple of years, simply sometimes it can happen in merely a couple of days. So let's look at the list here. The Panic of 1907 stocks vicious 20% in 1 day. Wall Street crash of '29 somewhen lost ninety% of its value over the next couple of years. The crash of '73, '74 the Southward&P lost 50% of its value during those two years. In the Flash Crash of '87 the Dow shed 22% in one twelvemonth. The Dot-com crash of 2000. The Nasdaq declined by forty% over two and a one-half years. The subprime crisis, the S&P 500 barbarous by over fifty% over 2 years. Finally, the COVID crash, the S&P roughshod by 35% in less than a month. Now hither'south a nautical chart of the Bully Depression, it shows the crash:

Now, i of the things about crashes, you see that the crash occurred in Oct of '29, only then the stock market began to recover. Information technology tried to recover during 1930s. So a lot of people have the impression that information technology was i and done, but it wasn't. But the key affair is that the market continued to fall before eventually reaching a bottom in 1932. At present, the reason why that's important is because sometimes crashes come and get like the Flash Crash of '87 or the Cracking Panic of 1907. They were over relatively apace. But in other cases, they lead to long-term bear markets.

At present, what'southward the driver of all of this? Well, the cardinal thing is the absence of, or the withdrawal of liquidity. Liquidity is simply the presence of willing buyers in the market. What tends to happen in a crash is that institutional sellers have decided to liquidate their positions for whatever reason, leaving merely retail sellers holding the stocks. When they realize that the institutional buying ability has left the market place, they too begin to try to sell. Because it's a less liquid market in other words, fewer sellers … price movements tend to become exaggerated and tend to autumn very rapidly. Now that'southward not ever the case. The Wink Crash of '87 is supposed to have been about electronic trading gone amiss. But in most cases what happens is withdrawal of liquidity, even in '87 that's what happened. It was but that the withdrawal of liquidity happened very speedily for systemic reasons.

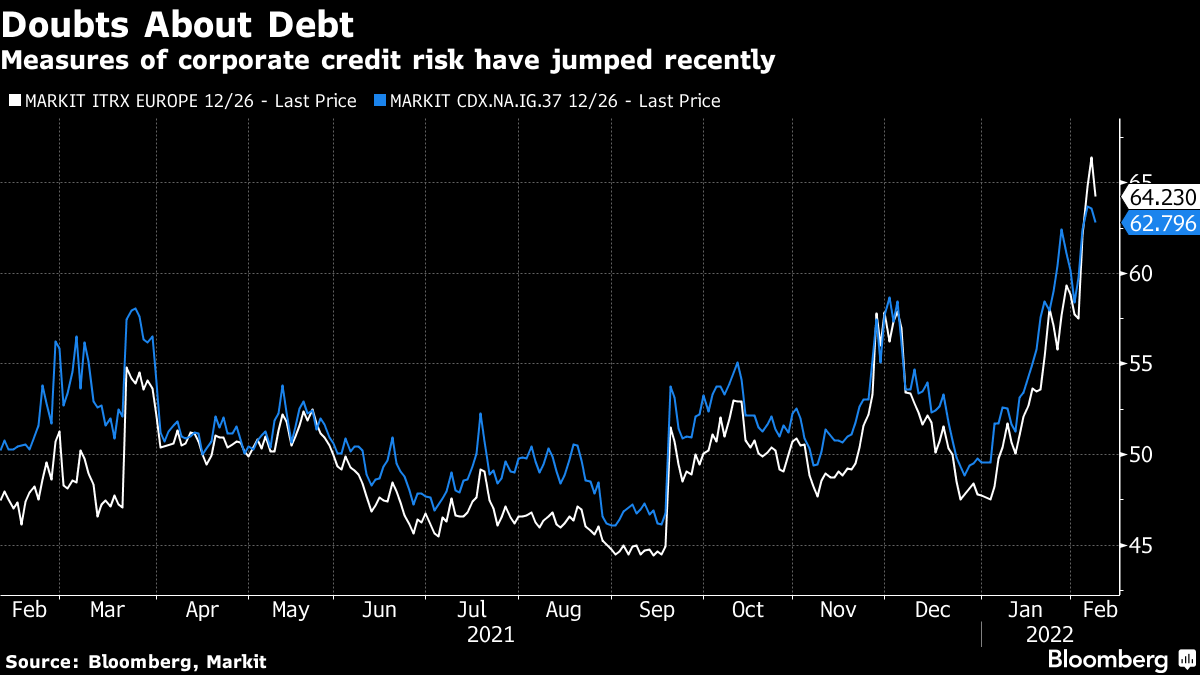

Now, what's the large threat? What is the thing that tends to cause a glitch in the markets turning into a crash? Well, the main matter is increasing credit take chances. Now the stock market is role of the financial system, so is the lending system. One of the near of import parts of the lending system is corporate debt. Corporate debt is typically ane of the biggest elements of debt next to the government and the household sector. Particularly what tends to happen in periods of fiscal instability is that you lot begin to come across the spreads of yields between low- or loftier-risk corporate debt and safe debt like x-year Treasury bonds. You lot begin to see those yields increase. So, the fundamental affair is that if y'all are in a situation like we are now, whereas I'll discuss in a moment, interest rates are going to ascent. Then one of the big things to look out for is what's happening with corporate credit spreads. Well, here's a nautical chart that shows the measures of corporate credit chance, which includes the spread:

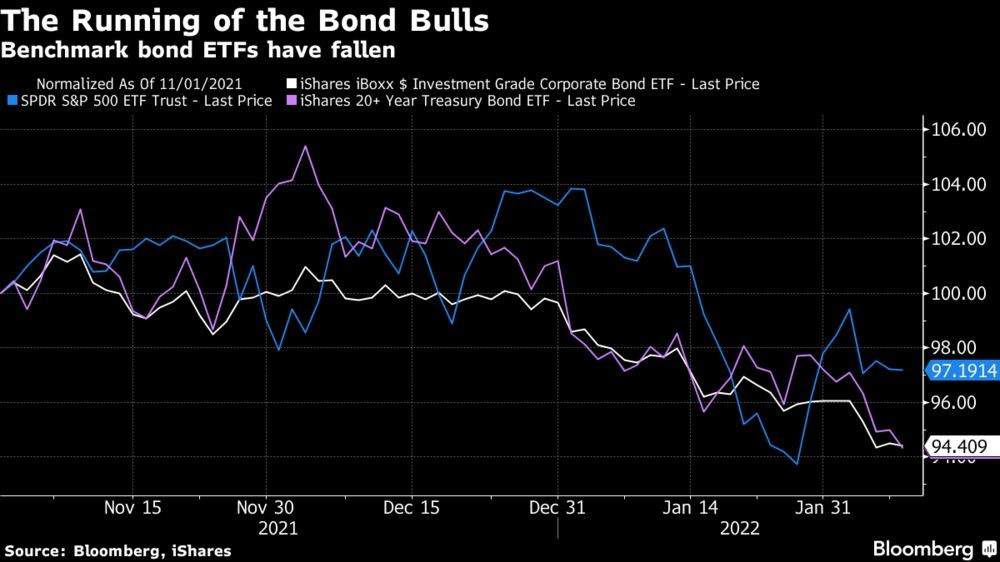

This comes from a marketplace in Bloomberg. It shows that since the beginning of this twelvemonth, concerns near the safety of high yield corporate debt have risen very substantially. The side by side nautical chart shows how ETFs which own or expose investors to corporate debt take fallen actually past more than the S&P 500:

Even though the S&P has rebounded a bit in the last couple of trading sessions, that hasn't been the case for these corporate bail ETFs. So that's one of the critical factors right now is that there seems to be nervousness about corporate debt in the market place.

At present, that'due south of import because corporate debt is obviously linked to companies. Many of which are listed on the stock market. When companies showtime running into trouble servicing their debt, either it'south considering they're non making much money or interest rates are ascension or something like that, and then you tin very easily see a credit crisis where substantially the market begins to fear the prospects for these companies. Then they refuse to reinvest every bit companies curlicue over their debt. Retrieve most corporate debt is on a two-year rolling basis. Companies consequence bonds, investors buy the bonds. The bonds are then redeemed in two years' time, and then they issue new bonds and new buyers roll them over. When that doesn't happen, that's when you get big credit crises.

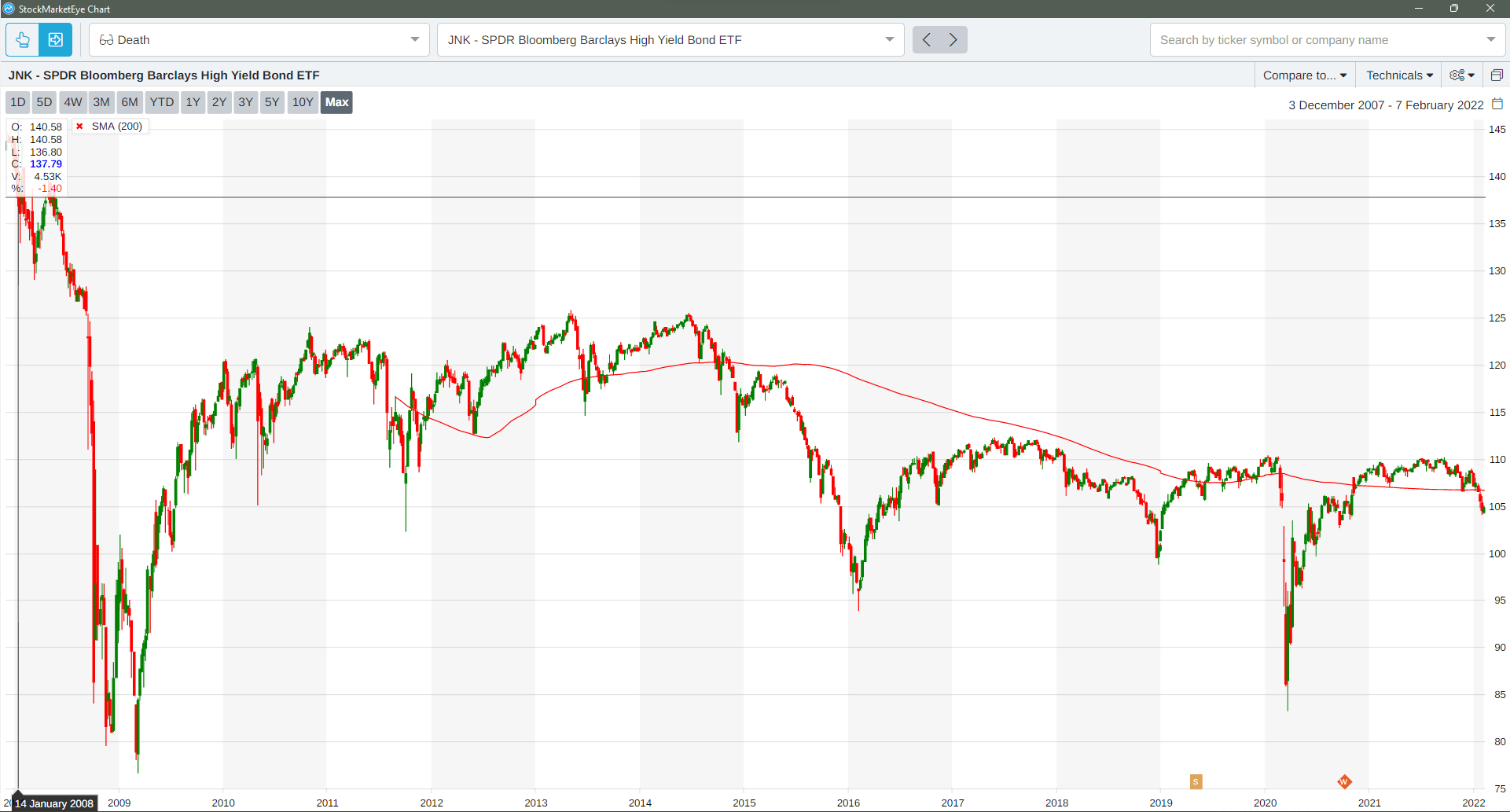

Now, the context we're in right at present is the interest rates have been extremely low for a long fourth dimension and that has led companies to borrow more than they would otherwise because all things being equal, the toll of money is very low. You're going to consume more of information technology and that'due south what credit essentially is. Well, here's a nautical chart that shows the long-term trend:

Again, this is looking at the Barclays High Yield Bond ETF. Essentially what's happened is that over time, the concerns about corporate health accept basically been fairly stable since the 2008 crisis. Bond spreads used to exist a lot higher. Junk bonds used to yield a lot more earlier the financial crisis, simply very depression interest rates take led to a decline in those yields because basically the even risky companies can infringe cheaply when easy money is there. So that's why I've included a trendline. You lot can run across that it has fallen since the 2008 crisis.

Now, "Why did interest rates fall then much and what led companies to borrow so much money and what could change?" Well, the offset affair is that over the grade of the 1980s and 1990s, there were a number of sovereign debt crises. They started in Thailand. There was contagion, information technology hit Russia. It hit other countries. Merely basically after that happened a lot of countries particularly in Asia began to accumulate big foreign substitution reserves. They essentially belonged to the national regime's banking company and that money had to become and practise something. Normally information technology would go out into the credit markets and that led to lower interest rates considering the higher the supply of credit … the more interest rates become down. This is not but virtually the Federal Reserve here. This is about a large supply of money coming from sovereign debt funds in or basically foreign commutation reserves in sovereign debt funds in strange countries.

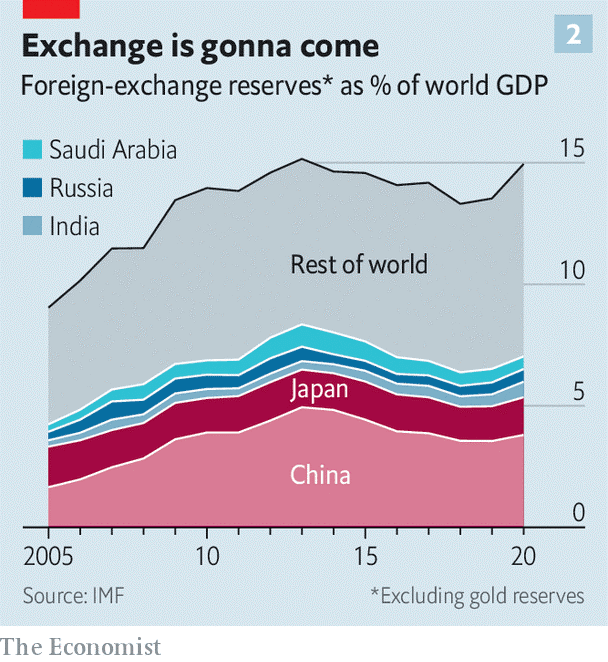

Now, hither'southward a chart that shows foreign substitution reserves as a percentage of world Gross domestic product and y'all can see that that money has just grown:

I hateful the amount of money since 2005 basically as percentage of world GDP we've gone from, we've increased by fifty% basically. So all those foreign substitution reserves tin cycle dorsum into credit markets very hands. That's one of the things y'all got to be extremely careful of.

Now in that location'south another chemical element, increased inequality. What's interesting, I looked this up. I'm just going to expect at my statistics hither … from 1983 to 2019 the share of American income going to the superlative x% of the population rose by fifteen%. The annual average saving by the top one% of households in the United States has been bigger than average annual net domestic investment since the yr 2000. That means that the meridian 1% of households in the United states of america save more than every year than the unabridged country invests in a single year. That means that all things being equal, the supply of money goes upwardly, and again that money has to get cycled dorsum into something productive so it goes back into credit markets and that lowers involvement rates.

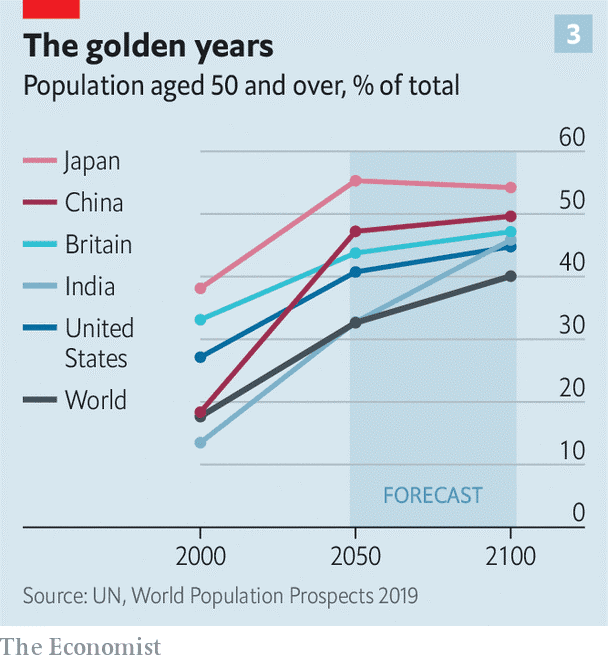

Nosotros've had global corporate saving. Global saving by companies rose from less than 10% of GDP in 1980 to fifteen% in 2015. Again, that basically means that there's more coin available from the corporate sector to lend out which pushes interest rates downwards. In fact, the corporate sector globally has been a cyberspace lender to the global economy, non a cyberspace borrower. Think of that. We're talking about junk bonds companies who borrow, only companies equally a whole have actually put more than money into credit markets than they've taken out. The last thing of course is the rise in the "over 50" population.

It was 15% in the 1950s, now information technology'southward 25%. So that'southward a big jump. I'm one of them. That's expected to ascension to 40% by 2100. I mean, that's a huge jump. Now, what happens is that older people salve money during their working lives so they can retire. That leads to, again, a lot of money moving into financial markets and that leads to lower involvement rates. This is in fact 1 of the biggest elements causing low involvement rates over time.

The estimates are that in the United States, aging … the increment in the number of people over 50 has actually contributed between ane% and 3% of the fallen interest rates since the 1980s. At present, why do I spell this all out? Considering everybody thinks it'due south about the Fed. It's not only about the Fed. At that place are long-term drivers of low interest rates and this has led to the supposition that interest rates will always be low. They've been low since most of us can remember, certainly virtually younger investors won't remember any kind of circumstances when interest rates were high. Merely that's where the Fed comes in.

The Fed is the other element, the other player that can raise interest rates by raising the yield on 10-year Treasury bonds. When they raise their target interest rates, the interbank rate which in turn causes Treasury bonds to go up. The Fed doesn't practice that direct. They can likewise buy bonds. That's what they've been doing, quantitative easing. Merely essentially it's a unlike fashion for interest rates to ascent. It runs counter to this long-term demographic and structural trend that I just described. But, now we have aggrandizement. Nosotros oasis't had inflation really since the 1970s. That really is the key deviation for the first time in almost investors' lifetime memory except for us sometime folks, inflation is now a serious business organization.

At present, the problem is the higher level of inflation. If the Fed starts raising interest rates … we are predicting about a ane.75 percentage point arise in the Fed'southward base rate only this year. That's going to drive up interest rates for corporate borrowers, particularly the junk bond borrowers, those rated triple-C or lower. Now, the higher the level of debt that companies accept, the bigger the clasp they're going to face when that really happens. That means that the economy and the stock market has become more sensitive to loftier interest rates considering they know that there's been a big jump in borrowing over the last … really over the last generation. At present, the economist estimated recently that companies and households and governments pay nearly $10.two trillion a twelvemonth in interest. At present, that's about 12% of global GDP. Now, if they were to raise involvement rates on the trajectory that everybody expects, that would bound from 12% of global Gross domestic product to 15% of global GDP. At present, if aggrandizement or if rates went up quicker, that could really take us from $x.ii trillion right now to $20 trillion in interest rate payments in 2026. That would exist 25% of global Gdp.

Now that'south where the other thing hits companies that are indebted. If you've got that much coin coming out of global Gross domestic product in debt repayments, that leaves less for companies or for people to spend on the products of companies. And then companies are getting it coming and going, right? They're paying more in interest on their accumulated debt. On the other hand, they're facing a refuse in consumption and this is what causes a withdrawal of liquidity in the markets because people begin to realize that if there'due south real danger, that a substantial number of companies could go belly upwardly because of credit tightening, credit conditions, rising interest rates and falling need. So you know that those companies' stocks are going to decline and that starts a route. Once people start to look at it, once they outset to consider this situation.

Now, this is why the situation is so important for you as an investor to think most and why looking at these junk bond spreads and yields should be part of your daily routine. Because they are the warning sign. They are what can warning you to where things are going. Now, y'all're going to see headlines too, merely understanding the concept of corporate debt yields and corporate debt spreads is critical to being able to expect beyond the horizon and see what might be coming. At present, I'm non proverb that'southward going to be a trouble right now, simply right now in the Usa corporate debt yields are but at iii.3% on average. That'south still below inflation. So these guys are essentially getting free money. If that changes, I mean you can run across that changing very rapidly if the Fed starts raising involvement rates, considering the yields volition spring.

Now, it simply takes a few defaults to basically go the bond market, the corporate bond marketplace, the buyers to say, "Uh-uh (negative) I'chiliad not going toward junk bonds anymore." Then they yield skyrocket because liquidity dries up in that credit market. That in turn puts pressure on the companies which puts pressure level on stocks. Now, i of the large dangers at this point is over the final 10 years in detail credit standards have client dramatically. It used to exist that companies had to enter into all kinds of covenants and they had to sign all kinds of side agreements agreeing to practice diverse things to satisfy the lenders that they were prioritized paying them offset. Well, that's basically all gone away. They don't fifty-fifty have covenants anymore that foreclose borrowers from going to another bank and borrowing fifty-fifty more money, which used to be a standard role of all credit extension in the corporate sector.

So in some, nosotros've gone from a situation where credit markets are priced for a world where nasty surprises don't happen and liquidity is arable all the time. The problem is that those assumptions are looking like they don't hold anymore. If that's the case, y'all need to be looking at corporate credit spreads and yields to know which way to go. Now, the key thing here is that this is a what-if not a definite. But it is 1 of the tools that yous need to have in your arsenal as an investor. Pay attention to the corporate credit market, pay attention to it globally considering if you lot face up a situation of rising involvement rates, rising debt service payments, and lowering consumption because of that, those ascension interest rates … boom, yous could have a crash. Just remember we always recover from a crash. We've recovered from every single one that I listed earlier. Then the key thing is if you get out at the right time, you get dorsum in when things are at a bottom and starting to motility support again … that's how yous make millions.

Anyway, this is Ted Bauman signing off. I'll talk to y'all again next week.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

Source: https://banyanhill.com/1-thing-cause-stock-market-collapse/

0 Response to "what happens to the bond market when stocks crash"

Post a Comment